- Home

- About Us

- S C Theory

-

S C Action

- Social Credit News

-

Social Credit Views

- Social Credit in Summary

- The Economics of Social Credit in Summary

- The A+B Theorem

- The Bank Creation of Money Out of Nothing

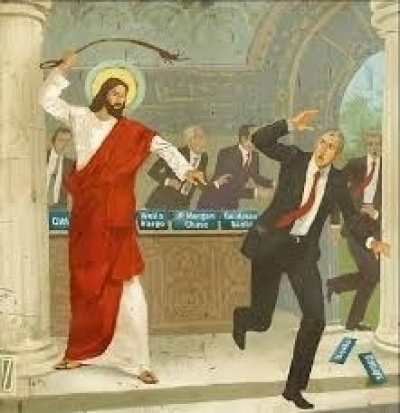

- Social Credit and Usury

- Social Credit vs. a Basic Income

- Social Credit and Leisure

- Social Credit vs. Socialism

- Social Credit and Income Inequality

- Social Credit and War

- Social Credit and Catholicism

- Social Credit and Distributism

- Action FAQ

- Resources

- Publications

- Contact us

- Donate