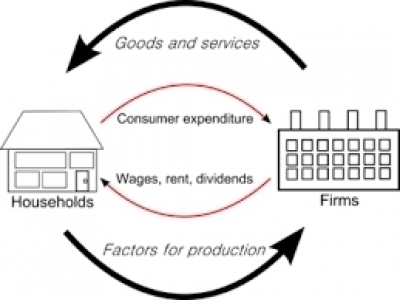

Social Credit is the brainchild of Major C. H. Douglas. During World War l, he was asked to sort out some problems at an aircraft factory in Farnborough and came across a discrepancy in their books. The factory generated costs at a much greater rate than it made available incomes to people. Thinking this curious, Douglas investigated a hundred or so British companies to discover that this imbalance was a general feature of modern industry. Wages, salaries and dividends paid to people by a factory, or other productive undertaking, were nearly always only a portion of total prices for goods made available by the same factory. This perplexed him because it guaranteed a quantity of goods that could not be sold, and what was the point of expending energy on making something that couldn’t, for financial reasons, be consumed?